03/02/2004

Forbes, March 6, 1989

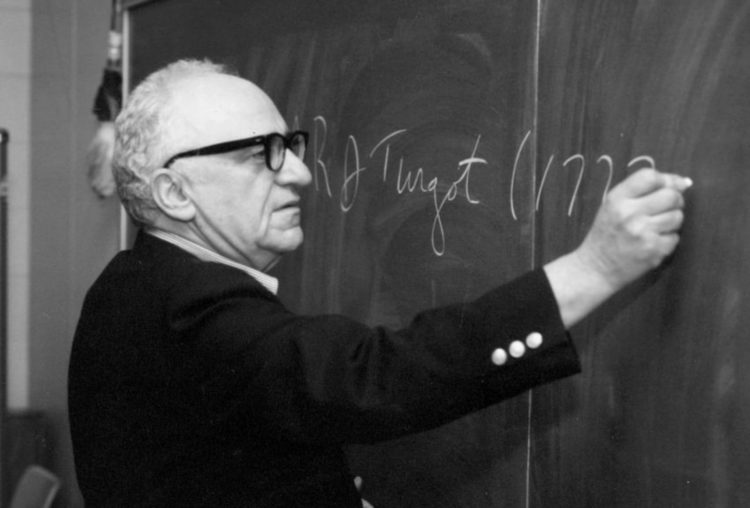

MURRAY N. ROTHBARD, 62, S.J. Hall Distinguished Professor of Economics at the University of Nevada, Las Vegas, emits a string of comically hyperbolic epithets and cackles demonically. He is the Happy Warrior of American economics. And he has a lot of fight about: As a leader of the "Austrian" school of economic thought, he has such faith in free markets that he regards Milton Friedman as a species of Keynesian.

Here’s how Rothbard describes his position: A recent New York Times article noted an emerging division between "salt water" economists, affiliated with universities on both coasts and favoring government intervention, and "fresh water" economists, mostly on the Great Lakes and skeptical of government intervention. Rothbard’s deep love of factional distinction was fired. He published a letter to the editor announcing the existence of a third school: "no water" economists from states like Nevada. The dries thought that the "fresh water" folk were "wimpy moderates" because they did not believe that all government intervention was "not only ineffectual, but also pernicious and counterproductive."

When Rothbard opposes all government intervention he means, well, all. He faults the British radical reformers of the 19th century — confusingly called "classical liberals" although their belief in market forces was diametrically opposed to the skepticism of modern American liberals — for leaving "the command posts" still in the government’s hands. ("Walter Bagehot [the great Victorian editor of The Economist magazine and a leading liberal spokesman] was a statist sellout!") These command posts include the mail, the roads, the currency — and the army.

The army? Sensing an interviewer’s incredulity, the valiant Rothbard veers into a defense of private armies. And, of course, it is true, for example, that the paralysis of New York’s police has resulted in the widespread employment of security guards, a partial privatization of the government’s supposed monopoly on force. But …

But it would be wrong to allow Rothbard’s more exuberant enthusiasm to distract attention from the serious import of his work — although that is arguably what has happened throughout his academic career.

Rothbard’s "Austrianism" dates back to his attending the informal New York seminars held by the Viennese economist Ludwig von Mises (1881-1973), a refugee from the Nazis who arrived in the U.S. in 1939. At that time, American universities were almost entirely dominated by Keynesians hostile to Mises' stress on free markets. Like his fellow "Austrian," Friedrich von Hayek, Mises was unable to find work with any economics department, ultimately teaching at New York University’s business school as an adjunct professor whose salary was paid by business admirers. But recently, particularly since Hayek was awarded the Nobel Prize for Economics in 1974, Austrianism has been attracting increasing attention in a world grown weary of government intervention’s failures.

Austrianism appears close to free-market economics of a familiar although still controversial cast, but its origins and its ultimate implications are significantly different.

Most academic economists, of whatever persuasion, think that economics is a science like physics or chemistry. Thus, the study of evidence is supposed to yield conclusions about causes, and all essential relationships can be expressed quantitatively. For example, most economists think the money supply works in the economy like heat on a test tube full of water: Increase it and you get specific, measurable and predictable effects. There might be debate about the degree. But it can all be resolved by more research.

The Austrians completely reject this view. They believe that economics is more like mathematics. It must be derived from axioms — in the case of economics, axioms about individual human activity and deductions therefrom, such as the fact that people respond to incentives. Thus Rothbard calls economics "the logical analysis of the implications of human action."

Austrians, however, also think economics is unlike mathematics in an important respect: Its key relationships are not constant enough to be expressed in numbers. Thus Austrians are particularly skeptical about the possibility of precise predictions from econometric models. Only general predictions, they say, can be made with any degree of confidence.

The classic example of the Austrian method: von Mises' famous conclusion in the 1920s that socialism could never work because no central authority could simulate by calculation the resource allocation decisions achieved under capitalism by the price mechanism. Mises argued the calculation was too complex. No amount of computational power could solve it.

Mises' adversaries elected to ignore him, but his analysis of socialism has arguably been borne out by the failure of the Communist bloc economies since his death. This analysis bodes ill for Gorbachev’s tinkering reforms.

Rothbard has launched a number of similar stories. For example, he has denounced the antitrust concept of monopoly prices, which he argues is a logical confusion except where the monopoly is supported by state intervention as when high tariffs protect a domestic producer from foreign imports. Rothbard thinks that antitrust laws are aimed at a chimera and should all be abolished.

Austrian skepticism about macro-economic measurement has precipitated a bitter conflict, prosecuted by Rothbard with his usual glee, between the Austrians and their apparent free-market allies, the Milton Friedman-style monetarists. Both schools agree that money matters — that the central bank cannot indefinitely expand the quantity of money in circulation without inflation. But the Austrians argued that the monetarist prescription, expanding the money supply at a fixed rate equivalent to the underlying growth rate of the economy, can’t work because it requires impossibly precise assumptions about the economy. Recent experience may validate this line of thinking: After 1982 the monetarists predicted renewed inflation because of Fed laxness. But this didn’t happen. It didn’t happen because of unexpected shifts in the velocity of money’s circulation — people were just more willing to hold cash.

Austrians, in fact, believe they can show by deduction that money originally developed spontaneously, without government intervention. They think it would be better that way today. Some are interested in the idea of free banking, by which the money supply would be determined by the banks' judgment of the demand for loans (FORBES, May 30, 1988).

But Rothbard, typically contentious, has attacked this idea on the grounds that fractional reserve banking — the system by which banks lend out more than their reserves — is inherently fraudulent. He favors forcing the banks to maintain full reserves, plus a rigorous gold standard. This, he argues, would result in a gradual, beneficent deflation as technology improved productivity. He says this is what actually occurred in the 19th century, when increased use of machinery and better transportation led to sharply lower prices for manufactured goods and a vast increase in the general standard of living.

Rothbard was apparently born fighting. The son of Jewish immigrants from Eastern Europe, he remembers as a child silencing a gathering of his extended family ("all Stalinists and fellow travelers") by interrupting their deploring the Spanish Civil War with the innocent inquiry, "What’s wrong with Franco anyway?" (Rothbard and Franco could hardly be further apart, but he says he couldn’t see why the communists were any better.) He won a scholarship to a Manhattan private school where his classmates were "all wealthy liberals," and he thinks he was one of two Republicans at Columbia University in the 1940s, when he got his Ph.D. in economics.

Rothbard’s radicalism has unquestionably harmed his academic career. For years he worked for a variety of free-market foundations, one of which funded his magnum opus, Man, Economy, and State. But the fifth volume of his history of the American Revolution, Conceived in Liberty, has never been published, and he says only half jokingly that he finally found his longtime academic niche at Brooklyn Polytechnic because his opposition to the Vietnam War, basically on isolationist grounds, made him acceptable to the left-wing staff.

Some Rothbard-watchers note, however, that his entry into an organization, like that of some bacillus, is invariably followed by convulsions. Rothbard’s once-close relationship with the Cato Institute, the Washington, D.C.-based libertarian think tank, has disintegrated despite their (relative) similarity of views. Could Rothbard’s thermonuclear polemical style and his sharp tongue — he always refers to Cato and its associates as the "Kochtopus," a jibe at its chief backer, Wichita oilman and Forbes Four Hundreder Charles Koch — have something to do with it?

Rothbard himself professes puzzlement at this idea. "I see error and I attack it," he says humbly. But he doesn’t like personal (as opposed to print) confrontations. To a casual observer he appears distinctly lovable — a word he himself regularly applies to an eccentric collection of controversialists in whom he takes an interest despite fundamental differences.

Rothbard in fact is interested in many things. He is fascinated by the relationship between religion and politics (it plays a major part in the history of economic thought he is currently writing). He effervesces with views on subjects as diverse as music (he once wrote an operetta satirizing the novelist Ayn Rand and her Objectivist movement, with which he had fallen out), 20th-century literature (bad) and Jewish women (worse). His 51-page bibliography includes hundreds of pieces of journalism.

This seems to be something of an Indian summer of Rothbard. He and his wife, longtime Manhattanites, have survived being transplanted to Nevada. His faction has helped wrest control of the tiny federal Libertarian party away from the "Kochtopus." He has found new allies in the Auburn University, Ala.-based Ludwig von Mises Institute, an independent foundation headed by an energetic direct-mail expert, Llewellyn H. Rockwell Jr., which funds scholarships, academic conferences and the Review of Austrian Economics, with Rothbard as editor. The Institute has just published a collection of essays originally presented in honor of Rothbard’s 60th birthday, Man, Economy and Liberty.

Unthinkable thought: Is Rothbard mellowing? The Austrian theory of the business cycle, as elaborated by Rothbard in his books, particularly America’s Great Depression, predicts that a Fed-stimulated inflationary boom must be followed by a cleansing collapse. But now, unlike many Austrians, Rothbard thinks the 1980 and 1981-82 recessions may have been enough to correct the distortions created by the previous inflationary decade. Inflation will eventually return, he says — Washington has "the power and the will" to prevent deflation — but the U.S. economy is simply not in the bad shape it was in 1980.

He isn’t one of those who sees disaster lurking in persistent federal deficits. Any attempt to "cure" the federal deficit by raising taxes "would be like curing bronchitis by shooting the patient in the chest."

Which may be a general prediction. But it’s pretty specific, coming from an Austrian school economist.

Peter Brimelow, editor of VDARE.COM and author of the much-denounced Alien Nation: Common Sense About America’s Immigration Disaster (Random House — 1995) and The Worm in the Apple (HarperCollins — 2003)

This is a content archive of VDARE.com, which Letitia James forced off of the Internet using lawfare.