02/28/2004

By Peter Brimelow and Leslie Spencer

Republished on VDARE.com on February 28, 2004

[First published in Forbes, September 17, 1990)]

Peter Brimelow Comments In 2004.

CONSUMER crusader Ralph Nader recently visited Moscow, along with the cameras of CBS' 60 Minutes, for a show to be aired this fall. According to an account in New York’s Village Voice, Nader was "shocked" when a Soviet official praised free-market economist Milton Friedman. He "protested" that plans to privatize Soviet television might give opportunities to Western corporations. And, taken aback by the complaints of Russian consumers standing in line for hours, he suggested:

"Some people say that because the Soviet people have to stand in line, it gives them time to reflect and become philosophical."

The entire crowd laughed at him.

Americans, however, are not laughing at Nader — yet. Indeed, when insurance executives were planning their futile $30 million effort to defeat California’s Proposition 103, the auto premium roll-back and regulation initiative that threw the industry into chaos in 1988, they shrank from attacking Nader directly although he was campaigning as the measure’s most visible advocate. Their cowardly rationale: Polls showed he was simply too popular.

Nader’s popularity is based on an almost unchallenged perception: that he is "Saint Ralph," as New Republic magazine once put it. "In all statistical probability, at least several dozen of you who are reading this issue of the New Republic would be dead today if Nader hadn’t single-handedly invented the issue of auto safety, " wrote editor Michael Kinsley, now co-host Of CNN’s Crossfire and one of many ex-Nader employees strategically placed in the elite media: "Ralph is living proof that there isn’t much difference between a fanatic and a saint."

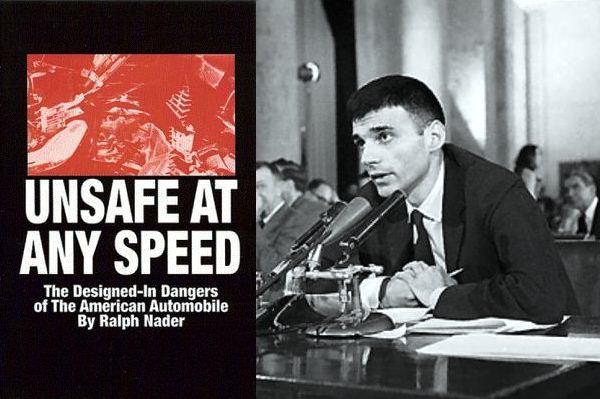

But saints attract myths as well as miracles. Nader did not single-handedly invent the auto safety issue. For example, Senator Abraham Ribicoff (D-Conn.) had long been interested in the cause. He was actually dramatizing his own proposed legislation on the famous occasion in 1966 when he dragged groveling General Motors executives before his subcommittee to confess that they had indeed set detectives onto Nader, whose Unsafe At Any Speed attacked-their Corvair.

Nor do statistics necessarily suggest that a Nader miracle has protected the New Republic subscription list. The fact is that U.S. traffic fatalities per 100 million miles traveled had fallen rapidly throughout the century, from 24 in 1921 to 5.3 in 1965. They have continued to fall since, to a recent 2.2. In 1965 the U.S. traffic fatality rate was about the lowest in the world-and it still is. Arguably, sheer economic growth and technological improvement have been the decisive factors here: Americans just consistently bought better, safer cars as they became available and affordable.

But there is an even more pervasive myth about Nader. As ex-Nader aide Gary Sellers once put it:: "Because Ralph is self-sustaining, he is responsible only to his own conscience. The others aren’t — they're in the middle of a web of interests, and they have to compromise their ideals to protect present income or future sources."

Last year FORBES found evidence that Nader had not in fact miraculously levitated above the "web of interests" in which other human beings are caught, but instead was intimately entwined with a group of rich lawyers: the plaintiff bar.

Our 1989 survey of the best-paid lawyers in America revealed that the top legal looters are not Ivy League corporate paper-pushers in Wall Street firms, but obscure plaintiff attorneys around the country-specialists in suing, often in personal injury cases. They are getting rich from the interaction of contingent fees, which get them 30% to 40% of any damage award in addition to expenses, and the litigation explosion resulting from the rewriting of "tort" law, covering personal injury and accidents, by a generation of reformist judges (FORBES, Oct. 16, 1989).

By rich, we mean very rich. Total contingent fee payments, excluding expenses, are now estimated to exceed $10 billion a year and to be rising. FORBES identified at least 62 plaintiff attorneys who made more than $2 million in each of the previous two years. Top moneymaker in 1988: Houston’s Joe Jamail, with $450 million to $600 million.

Perhaps out of an uneasy conscience, the plaintiff attorneys were eager to tell us about their financial support of the noble Nader.

"We are what supports Nader, " said Pensacola’s Frederic Levin ($7.5 million, 1988 income). "We contribute to him, and he fundraises through us." "We support him overtly, covertly, in every way possible," said San Antonio’s Pat Maloney ($6 million). "I should think we give him a huge percentage of what he raises."

Why? Says Austin’s Bob Gibbins ($3.7 million): "Nader supports all of our issues, and we support all of his."

The most visible aspect of this mutual support is the devastating bombardment of unfavorable publicity that Nader and his affiliates, through their unrivaled media contacts, are able to bring down on corporations which are simultaneously defending a product liability issue. Nader organizations have collaborated in such recent firestorms as the Audi 5000’s alleged "sudden acceleration," which government investigators subsequently showed to be totally false.

Regardless of the merits, bad publicity can cripple a defendant’s business and compel him to consider settling out of court in the hope of a quiet life-generally the most profitable outcome for the plaintiff attorneys. And for Nader, successful lawsuits are just another way of imposing his policy prescriptions, despite the plaintiff attorneys' expensive rakeoff.

When American Tort Reform Association former president James Coyne asked Nader about his plaintiff attorney funding at a press conference in Washington, he stormed from the podium and his supporter, Jay Angoff, rushed over and punched Coyne in the eye. (Angoff says it was a "very very mild shove.") Nader has refused to talk to FORBES, but in a press-time fax he insisted: "Over the past 30 years, not I % of the total funds raised by all our organizations have come from the legal profession."

Nader’s hypersensitivity is easily explained. No one in American public life has been freer with accusations that his opponents are compromised by their own financial sources.

On May 10 there were bitter exchanges during Senate Consumer Subcommittee hearings on the Product Liability Reform Act, an attempt to stabilize the tort crisis. Two co-sponsors, Senators Jay Rockefeller (D-W.Va.) and John Danforth (R-Mo.), objected to a letter Nader had published in their home newspapers, attacking their interest in tort reform and accusing them of being "huddled in Washington with corporate lobbyists, many of whom finance your [the Senators'] campaigns … taking away the existing rights of injured or sick people against the perpetrators of their harm."

Public Citizen’s Sidney Wolfe, appearing as a witness, interjected angrily that Danforth was "lying" for suggesting that the organization was "talking for the economic trial lawyers." Wolfe claimed that Nader "has had no connection with Public Citizen since 1980" — although Nader’s identification with his flagship is so complete that his name is emblazoned on its recent direct mail campaign envelopes. Confronted with FORBES' Oct. 16 article, Wolfe asserted it contained "several mistakes" and implied that Nader’s response had forced a FORBES "retraction or correction." (Quite untrue.)

Wolfe grudgingly said he would provide details of Public Citizen’s own financing by trial lawyers "if it is possible." Somehow, it wasn’t.

Nader tactics in the face of this sort of inquiry apparently haven’t changed in nearly 20 years. In 1972 New Republic linked the fact that Nader’s Center for Auto Safety had accepted a $10,000 check from the Association of Trial Lawyers of America to his opposition to no-fault insurance. Wall Street Journal editor David Sanford, in his book "Me & Ralph: Is Nader Unsafe for America" recounts Nader’s reaction: (1) refusal to discuss the subject; (2) a "hysterical, personally abusive" counterattack; (3) a claim that the Center for Auto Safety was independent of him, although Sanford later confirmed that Nader was intimately involved in the organization; (4) a claim that a New Republic note that its story did not say Nader’s position was actually "determined" by ATLA’s check was a "retraction."

Encouraged by all this, FORBES has performed a Nader-type raid on Nader. But let’s be clear: We're not saying that Nader’s views are "determined" by his financing. We're being more charitable about him than he is about his own opponents. Nader’s views could well just coincide with his backers'. But his contacts could also have consequences.

For example, in 1988 Nader and California plaintiff attorneys agreed to exchange his credibility for their money. Nader came out in opposition to Proposition 106, a popular contingent-fee limitation measure.

"[106] was certain to pass," says Claremont, Calif.’s Herb Hafif (1988 income, $40 million). "It had 70% -to-approval 80% ratings among the public, and no one [in the plaintiff bar] thought it could be taken on directly. … Finally I asked Ralph to help, and he did … and I helped his 103 initiative, and it passed by a few points, and we beat 106 by a few points."

This was not a sellout but a true compromise. It’s embarrassing for Nader to be attacked for his studied passivity on contingent fees and the many other anticonsumer practices of the plaintiff bar. And the plaintiff attorneys presumably don’t really want to destroy the insurance companies, the "deep pockets" that pay their fees and pass the costs on to consumers. But both sides sank their differences to make an effective alliance.

It just wasn’t especially saintly.

We're also not investigating Nader’s personal finances. But he has made his austerity vow central to his public image. He told the Washington Post last summer that he lives on less than $10,500 a year. (In a fax reply to our questions, he amended it: "Closer to $15,000, now. Insurance premiums sharply up.") We take this with a pinch of low-sodium seasoning.

"Oh God, limousines and nothing but the best hotels," says a disillusioned former state Trial Lawyers Association official. "We got quite a bill when he was in town." Nader’s agent says he makes 50 to 100 appearances a year, charging a sliding scale; FORBES has heard of five-figure fees, suggesting an upper limit of $1 million speaking income alone.

Nader has confirmed to FORBES that his total earnings were around $250,000 a year back in the early 1970s — "funds devoted to our causes." But this is another Nader miracle/myth that needs to be set in perspective. Nader’s "causes" are usually tax-exempt entities. Giving money to them is not the same as giving a quarter to a street person. It can generate tax deductions — as well as, in effect, financing Nader’s own business. Indeed, Nader may personally own the Public Safety Research Institute (net worth, $649,000), because he has registered it under Delaware’s peculiar nonprofit law — an irony, because he has denounced business' taking advantage of the state’s liberal incorporation rules.

Another Nader miracle/myth: his long-standing claim that he lives "in a simple room" near his office. Even Nader’s close associates apparently aren’t told the address. And he personally repeated the story to the New York Times' Philip Shenon last year.

But neighbors say, and have said for nearly 20 years, that Nader lives in a townhouse, worth perhaps.$1.5 million and assessed at $7,400 annual property taxes, on Bancroft Place in northwest Washington, D. C. (see picture, p. 117). District records show the deed is held by Nader’s sister Claire, who seems to work in his organization. (Nader still denies this, and will say only that his sister "works on a number of civic projects and research programs. ")

There’s nothing shocking about living well, except by Nader’s peculiar standards. His many admirers would certainly be happy to buy him an ecclesiastical palace. But maybe that would suggest he was not a saint but human — even, possibly, fallible.

FORBES estimates Nader has control to varying degrees over 29 organizations with combined revenues of $75 million to $80 million and assets of at least $23 million (see chart, p. 120).

We faced three problems:

And although Nader has campaigned for federal chartering of corporations on the grounds that they tend to be controlled by "a management autocracy," this exactly describes his own organizations. Nader’s control over his nucleus appears absolute. And even some Nader affiliates that accept a "membership," like Public Citizen, have no provisions for internal democracy. By contrast, full members of the National Rifle Association get to vote on board members and other aspects of its governance.

But then, they don’t have the advantage of being saints.

All of which eerily resembles nothing so much as John D. Rockefeller’s original secret Standard Oil Trust. This "shrewd and slippery device for evading responsibility," in the words of the great muckraking journalist Ida Tarbell, "had no legal existence. It was a force as powerful as gravitation and as intangible. You could argue its existence from its effects, but you could never prove it. You could no more grasp it than you could an eel."

Questions to the Standard Oil Trust had to be phrased with extreme care because of a bland pretense that there was no one here but us chickens working "in harmony," and because of an unsaintly penchant for legalistic loopholes. The Nader Trust is just the same but considerably ruder.

Presumably one reason for this behavior: deniability. Thus key Nader henchperson Joan Claybrook, Public Citizen’s president, said last year that "we have 50,000 members [contributors of $50 or more]. I would be surprised if there were 20 members of the plaintiff bar among them."

Claybrook could have told us that, apart from Public Citizen, three Nader affiliates were openly funded by plaintiff attorneys to the tune of almost $1 million. And that she was on the board of one of them.

Another possible reason for the Nader Trust’s secrecy: It’s partly built with tax-deductible money. Up to 40% of all its funds are what Washington calls "tax expenditures" — money that would otherwise be in government hands. And just as the legal environment of the time made it difficult for Rockefeller to organize across state lines, the complications of tax law today may well make it hard for Nader to simultaneously generate propaganda, lobby and campaign for his political candidates while preserving deductible status. For both Rockefeller and Nader, noninvolvement may be a necessary legal fiction.

Already the Federal Election Commission has fined one Nader loose affiliate, the Illinois Public Action Council, for illegal use of funds in a political campaign. The FEC is currently considering a complaint by the National Republican Senatorial Committee alleging massive use of tax-exempt money in the 1988 election by Citizen Action and its affiliates in alliance with the UAW, the National Education Association, the Machinists and other labor unions.

Who supports the Nader Trust? Despite its best efforts, the web of interests' outline is clear (see chart, above).

Some threads of this web merit particular attention:

The Nader Trust has also muscled subsidies for its Citizen Utility Boards out of the utility industry-and, more spectacularly, for its PIRGS — out of student dues at many colleges, although most PIRG activity is off-campus and political. Both methods have suffered from court challenges. But when a UCLA student referendum recently barred CALPIRG from fee collecting, its lobbyists in Sacramento attempted to restore that source of funding.

All very creditable, if creepy. But remember that this successful solicitation partly depends on offering a tax deduction in return. And the issues raised on the doorstep — clean water and apple pie-are not alarmingly political … at first.

Remember also that the cost of this money can be high-sometimes up to 70% of gross — and it takes a lot of organizing. Still worth it, of course, not least because the presence of canvassers on the doorstep is in itself politically useful. Indeed, Citizen Action’s Edwin Rothschild directly told FORBES that its canvassers push political candidates — a flagrant breach of their nonprofit status that Executive Director Ira Arlook was anxious to deny.

Public Citizen may not. But Claybrook is cochair of Advocates for Highway and Auto Safety (revenues, $1 million), which is funded by the insurance industry. And the Center for Auto Safety took in contributions of over $200,000 last year from Allstate and State Farm foundations.

This relationship is no surprise to the embattled minority of non-Naderite promarket consumer groups. "In fact, industry is not actually on our side," says Consumer Alert’s Barbara Keating-Edh, "because they use regulations to gain a competitive edge."

The edge the insurance industry seeks is to staunch its claims outflow-in any way. Nader can help pass costs on: for example, to Detroit and the consumer (expensive mandatory safety devices) or the government (more expensive roads) or the motorist (speed limits, crash helmets).

Nader is acutely aware of this industry hankering. He was openly power-brokering at last year’s Professional Insurers Agents convention, one of many insurance forums he regularly addresses, urging the industry to "sit around the table" with him and use its "muscle" to support his current panaceas-and to abandon tort reform, which he warned would bring "an incredible backlash."

Insurance companies are notoriously short-sighted. But even a blind and stupid industry might have gotten the message after Proposition 103. Nevertheless, the insurers coughed up for Advocates for Highway and Auto Safety the next year.

Adding insult to injury, Nader made an extraordinary intervention into the 1990 California Democratic gubernatorial primary. Supporting plaintiff attorney-linked John Van de Kamp against Diane Feinstein, he said that with a vote for Feinstein "You might as well write a check to Aetna and State Farm" — two of the very insurers that write checks to the Nader Trust.

So Nader was soliciting a major plaintiff attorney contribution right at the moment of creation. Typically, Speiser himself is an aviation law specialist and stood to benefit from his "charitable" act.

Despite Claybrook, plaintiff attorneys who are members of Public Citizen are easy to find. "I contribute regularly," says Knoxville’s J.D. Lee (estimated 1988 income, $1.5 million). "I probably give them [consumer groups] 5% of my income," says Miami’s J.B. Spence (1988 income, $2.5 million). "TLPJ, Public Citizen, I belong to all of them. .. It’s a mutual exchange thing."

All this and tort reform, too. "Whenever a state Trial Lawyers Association has a bill that they are really concerned about," says the disillusioned former state TLA official, "and it looks as though they need a heavy, they bring in Ralph." Nader recently made such interventions in Pennsylvania and California. Our source says Nader attends state TLA conventions, for a fee, "winter and summer."

If idealistic canvassers are Nader’s foot soldiers, the plaintiff attorneys are his cavalry, sure and swift.

"Ralph might call me and say, would you support such and such a group and I would say yes," says Houston’s Richard Warren Mithoff (1988 income, $ 7.4 million), himself a former Raider. "Or he might say, if you could contact some lawyers-and others-and see if they would be interested in supporting such and such a group." Mithoff says he’s "certainly given money" to Public Citizen.

Does this web of interest have implications? Well, maybe so.

How Nader will resolve is conflict is clear from the recent controversy over federal Corporate Average Fuel Economy regulations CAFE): In an interview with Barron’s David Henderson, Nader sided with the environmentalists in demanding that CAFE standards be increased, although this pushes people toward smaller cars that are less crashworthy. Naderites argue that smaller cars should just have more safety devices-although these must tend to raise costs and price out the marginal consumer.

Illogical for a safety and consumerism advocate-but a necessary compromise for a tough professional agitator balancing in his web of interests.

FORBES does not claim that Ralph Nader is corrupt, although he’s clearly a case of what historian Richard Hofstadter described in his celebrated essay The Paranoid Style in American Politics:

"Overheated, oversuspicious, overaggressive, grandiose and apocalyptic in expression … . His sense that his political passions are unselfish and patriotic, in fact, goes far to intensify his feeling of righteousness and his moral indignation."

Nader may be a genius at touching this paranoid strain in the American people. He’s also unsaintly-and untrustworthy-at any speed.

TABULAR DATA OMITTED

Peter Brimelow, editor of VDARE.COM and author of the much-denounced Alien Nation: Common Sense About America’s Immigration Disaster (Random House — 1995).

This is a content archive of VDARE.com, which Letitia James forced off of the Internet using lawfare.