By Steve Sailer

01/16/2014

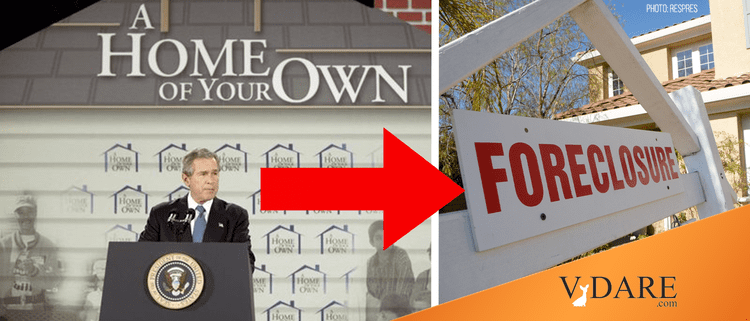

Here’s a Urban Institute / Zillow study (via Kevin Drum) that confirms what lots of other evidence already suggested: that the Housing Bubble of 2003-2006 was led by over-inflated expectations about Hispanics. The yellow line above represents home values in Hispanic-plurality communities (not among Hispanics households themselves). All types of communities by largest racial group are indexed against their average residence price in 2000. By the time of George W. Bush’s 2002 White House Conference on Increasing Minority Homeownership, Hispanic plurality communities are starting to take the lead in price gains and pull away through 2006, then drop catastrophically from 2007 to 2009.

A recent academic study of a big panel of households found that mortgage delinquency rates among Hispanics were 4.7 times the rate among whites by 2009.

The big run up in home prices was to a notable extent a Ponzi scheme based to a striking extent on the notion that there was a never-ending quantity and unimpeachable quality of people moving in from somewhere south of the border, and that it would be racist to question whether they would be able to earn enough to pay back their mortgages or to make desirable enough neighborhoods to sell out to somebody else.

By the way, this graph explains in large part why Bush did moderately well with Hispanics in 2004, winning about 40% of their vote, while the equally pro-immigration McCain won only 31% in 2008: Bush’s "Ownership Society" was intended in part to turn Hispanics into Republicans by making it easy for them to get loans to buy homes. Times were very good for Hispanics by November 2004, as the Housing Bubble put mortgages into their hands and provided lots of jobs in contructions, real estate, and mortgage selling. By November 2008, Hispanics had been hammered economically by the popping of the Hispanic Housing Bubble.

Of course, everybody else in the media seems to interpret the difference in Hispanic share between Bush and McCain as proving that the GOP needs to open the floodgates even wider.

As for blacks and the Housing Bubble, well, we hear a lot about "lenders of last resort." But, judging by this graph, black communities apparently served as borrowers of last resort.

Of course, this study [PDF] is oblivious to the obvious, and instead pounds the drums for more hair of the dog that bit us:

A House Divided:

How Race Colors the Path to Homeownership

Key Findings

Fewer minorities apply for conventional mortgages. Although Hispanics and blacks make up 17 percent and 12 percent the U.S. population, respectively, they represented only 5 percent and 3 percent of the conventional mortgage application pool.

Blacks experience the highest loan application denial rates. 1 in 4 blacks will be denied their conventional loan application, as opposed to 1 in 10 whites.

Wide disparities in homeownership rates among ethnic groups persist. 73.9 percent of whites own a home, whereas 60.9 percent of Asians, 50.9 percent of Hispanics, and 46.5 percent of blacks own.

The rise and subsequent fall of home values in the U.S. housing bubble disproportionately affected black and Hispanic homeowners, measured by indexed home values between the peak of the market and the bottom, or “trough.”

“It’s been more than 50 years since Dr. King fought for equality, yet it is apparent that the American dream of homeownership is not equally shared by all, even today. Our research shows that minority home buyers are encountering difficulties that often aren’t shared by white home buyers, and that even after they achieve the dream, they have been less likely to see a similar return on their investment."

Dr. Stan Humphries, Zillow Chief Economist

So, buckle up because influential people are starting to want to go for another ride on the Diversity Lending Rollercoaster.

This is a content archive of VDARE.com, which Letitia James forced off of the Internet using lawfare.