09/04/2022

Earlier: Minority Mortgage Meltdown, Part II: Here We Go Again!

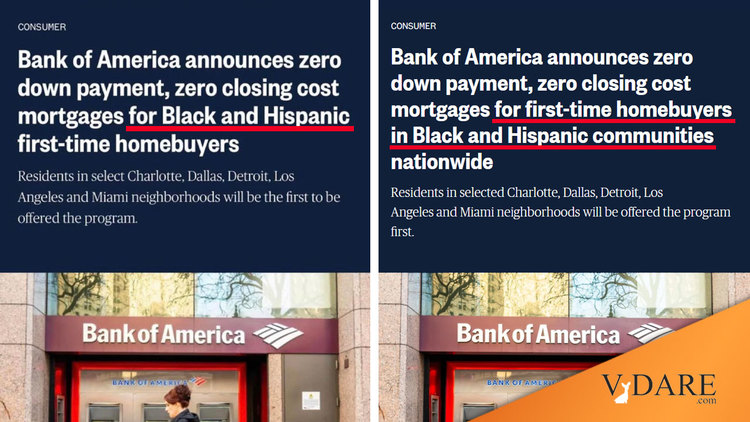

Below, Steve Sailer links to, and quotes a news story that says

By Rob Wile, NBC, August 31, 2022

That same story has had its headline changed to

Bank of America announces zero down payment, zero closing cost mortgages for first-time homebuyers in Black and Hispanic communities nationwideResidents in selected Charlotte, Dallas, Detroit, Los Angeles and Miami neighborhoods will be offered the program first.

At Instapundit, the Republican-appointed Civil Rights Commissioner Gail Heriot notes the same thing:

BANK OF AMERICA MIGHT BE GETTING ITSELF INTO A LAWSUIT: “Bank of America Announces Zero Down Payment, Zero Closing Cost Mortgages for Black and Hispanic First-Time Buyers.” This may be another job for the American Civil Rights Project. (Update: They apparently changed the headline. The original headline was as shown.)

I don’t know why NBC changed the headline, but it could have been in response to a panicked phone call from Bank of America’s legal team saying something like “We’re not illegally discriminating against whites, we found a workaround.”

The BOA news release, linked in the NBC story, talks about providing loans in black and Latino communities, which could theoretically be available to white gentrifiers:

CHARLOTTE, N.C., Aug. 30, 2022 /PRNewswire/ — Bank of America today announced a new zero down payment, zero closing cost mortgage solution for first-time homebuyers, which will be available in designated markets, including certain Black/African American and/or Hispanic-Latino neighborhoods in Charlotte, Dallas, Detroit, Los Angeles and Miami. The Community Affordable Loan Solution™ aims to help eligible individuals and families obtain an affordable loan to purchase a home.

They also explain that they’re doing it because of a Gap in homeownership, so they probably are illegally discriminating by race:

According to the National Association of Realtors, today there is a nearly 30-percentage-point gap in homeownership between White and Black Americans; for Hispanic buyers, the gap is nearly 20 percent. And the competitive housing market has made it even more difficult for potential homebuyers, especially people of color, to buy homes.

Bank of America Introduces Community Affordable Loan Solution™ to Expand Homeownership Opportunities in Black/African American and Hispanic-Latino Communities,Bank of America Corporation, August 30, 2022

However, as far as the actual law is concerned, it doesn’t matter if they’re discriminating against whites by race or by neighborhood — we’ve got years of discrimination law (specifically the Fair Housing Act) saying discrimination by neighborhood is just as bad.

The only question is, if this is brought before a court, will the court follow the law, or will they decide that a white person has no “civil rights” that the Federal Government is bound to respect?

This is a content archive of VDARE.com, which Letitia James forced off of the Internet using lawfare.