10/27/2013

Heart of speech starts at 10:44

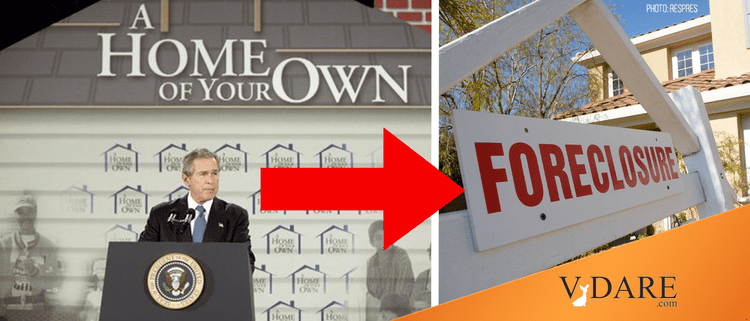

The 2002-2004 role of George W. Bush in setting off the housing bubble in the name of fighting racial inequality is still not widely understood. Republicans can’t believe their hero would campaign to undermine traditional credit standards, and Democrats can’t believe their enemy would wage war on down payments and documentation in the name of equality for minorities.

Another reason is that we get much of our history from Youtube, so if it’s not on Youtube, it basically didn’t happen. But Youtube dates from 2005; therefore, many of Bush’s first term speeches are barely accessible.

I finally found one Youtube clip of Bush’s first speech (June 17, 2002) promoting his White House Conference on Increasing Minority Homeownership, but it had been edited to understate the absolutely central rhetorical role of blacks and Hispanics in how Bush justified his program.

But hours of searching didn’t turn up any other clips.

That seemed strange because Bush assiduously had his speeches videotaped and posted on WhiteHouse.gov. But, the Obama Administration quickly erased their predecessor’s postings from WhiteHouse.gov. So, Google’s standard place to look for Bush’s speeches was largely wiped cleaned soon after January 21, 2009, leaving a big hole in the video historical record.

There is a federal archive for Bush’s old speeches, https://georgewbush-whitehouse.archives.gov/, but it is virtually text only. I’m a text guy, so that was fine for me, but I was long overlooking the Youtube Effect.

Fortunately, this weekend, after a couple of days of looking, I have stumbled upon UC Santa Barbara’s American Presidency Project, which has a trove of videos of previous Presidents.

In the post below, I've posted a video of Bush’s speech at his October 15, 2002 White House Conference on Increasing Minority Homeownership. But, it’s a painful effort even by Bush’s standards.

Therefore, above is Bush’s considerably snappier June 17, 2002 speech on how down payment requirements hurt blacks and Hispanics, delivered at the St. Paul African Methodist Episcopal church of Atlanta. The opening 10+ minutes are Bush’s usual shout outs to countless individuals in the audience. The meat of the speech begins at 10:44.

For some reason, I can’t get Youtube to start it right at 10:44. Thus, the embedded video above begins with Bush meandering aimlessly for 20 seconds from 10:24 through 10:43, but then President actually gets it in gear and gives a surprisingly cogent outline of his disastrous plan.

Here’s the best part of the transcript:

Three-quarters of white America owns their homes. Less than 50 percent of African Americans are part of the homeownership in America. And less than 50 percent of the Hispanics who live here in this country own their home. And that has got to change for the good of the country. It just does. (Applause.)

And so here are some of the ways to address the issue. First, the single greatest barrier to first time homeownership is a high downpayment. It is really hard for many, many, low income families to make the high downpayment. And so that’s why I propose and urge Congress to fully fund the American Dream Downpayment Fund. This will use money, taxpayers' money to help a qualified, low income buyer make a downpayment. And that’s important.

One of the barriers to homeownership is the inability to make a downpayment. And if one of the goals is to increase homeownership, it makes sense to help people pay that downpayment. We believe that the amount of money in our budget, fully approved by Congress, will help 40,000 families every year realize the dream of owning a home. (Applause.) Part of the success of Park Place is that the city of Atlanta already does this. And we want to make the plan more robust. We want to make it more full all across America. …

A third major barrier is the complexity and difficulty of the home buying process. There’s a lot of fine print on these forms. And it bothers people, it makes them nervous. And so therefore, what Mel has agreed to do, and Alphonso Jackson has agreed to do is to streamline the process, make the rules simpler, so everybody understands what they are — makes the closing much less complicated.

We certainly don’t want there to be a fine print preventing people from owning their home. We can change the print, and we've got to. We've got to be wise about how we deal with the closing documents and all the regulations, but also wise about how we help people understand what it means to own their home and the obligations and the opportunities.

And so, therefore, education is a critical component of increasing ownership throughout America. Financial education, housing counseling, how to help people understand that there are unscrupulous lenders. And so one of the things we're going to do is we're going to promote education, the education of owning a home, the education of buying a home throughout our society.

And we want to fully implement the Section 8 housing program, homeownership program. The program will provide vouchers that first-time home buyers can use to help pay their mortgage or apply to their downpayment.

Many of the partners today, many of the people here today, many of the business leaders here today are creating a market for the mortgages where Section 8 vouchers are a source of the payment. And that’s good — see, it’s an underpinning of capital. It helps move capital to where we want capital to go.

And so these are important initiatives that we can do at the federal government. And the federal government, obviously, has to play an important role, and we will. We will. I mean, when I lay out a goal, I mean it. But we also have got to bring others into the process, most particularly the real estate industry. After all, the real estate industry benefits when people are encouraged to buy homes. It’s in their self interest that we encourage people to buy homes. (Applause.) …

That’s why I've challenged the industry leaders all across the country to get after it for this goal, to stay focused, to make sure that we achieve a more secure America, by achieving the goal of 5.5 million new minority home owners. I call it America’s home ownership challenge.

And let me talk about some of the progress which we have made to date, as an example for others to follow. First of all, government sponsored corporations that help create our mortgage system — I introduced two of the leaders here today — they call those people Fannie May and Freddie Mac, as well as the federal home loan banks, will increase their commitment to minority markets by more than $440 billion. (Applause.) I want to thank Leland and Franklin for that commitment. It’s a commitment that conforms to their charters, as well, and also conforms to their hearts.

I saw that $440 billion figure in the newspaper in 2002, and said to myself, "$440 billion here, $440 billion there, pretty soon … "

This means they will purchase more loans made by banks after [African] Americans, Hispanics and other minorities, which will encourage homeownership. Freddie Mac will launch 25 initiatives to eliminate homeownership barriers. Under one of these, consumers with poor credit will be able to get a mortgage with an interest rate that automatically goes down after a period of consistent payments. (Applause.)

Fannie Mae will establish 100 partnerships with faith-based organizations that will provide home buyer education and help increase homeownership for their congregations. I love the partnership. (Applause.)

The Enterprise Foundation and the local initiative support corporation will increase efforts to build and rehabilitate more homes in inner cities at affordable prices by working with local community development corporations.

In my home state of Texas, Enterprise helped turn the once decaying ideal neighborhood of Dallas into a vibrant community, by building homes that were sold to residents at affordable prices. The National Association of Home Builders will team up with local officials, home builder associations and community groups in 20 of our nation’s largest housing markets, to focus on how to eliminate barriers, and encourage homeownership.

The Neighborhood Reinvestment Corporation will dramatically expand financial and home buyer education efforts to 380,000 minority families. The Neighborhood Housing Services of America will raise $750 million to promote homeownership initiatives in many communities. We're beginning to use the Internet better, so that realtors all across the country will be able to call up programs all designed to help minority home buyers understand what’s available, what’s possible, and what to avoid. The National Realtors Association will create a central data bank of affordable housing programs, which will be made available to agents, real estate agents, to help people.

So these are some of the beginnings of a national effort. And I want to thank all those who are responsible for the organizations I just named for lending your talents to this important effort for America. You know, one of the things Presidents can do, is they can call the old conference. So I’m going to call one — (laughter) — just to make sure people understand, not only are we serious, but to let them check in. If they've signed up and said they're going to help, this will give everybody a chance to say, here’s what I've done to help. It’s what we call accountability. (Applause.)

And so this fall, we're going to have a White House conference. It is a White House conference specifically designed to address the homeownership gap. It is a White House conference that will not only say, what have you done to date, have you got any new ideas that we can share with others as well. I’m serious about this. This is a very important initiative for all of America. See, it is a chance for us to empower people. We're not going to talk about empowering government, we're talking about empowering people, so they have got choices over their lives. (Applause.)

I want to go back to where I started. I believe out of the evil done to America will come incredible good. I believe that as sure as I’m standing here. I believe we can achieve peace. I believe that we can address hopelessness and despair where hopelessness and despair exist. And listen, I understand that in this great country, there are too many people who say, this American Dream, what does that mean; my eyes are shut to the American Dream, I don’t see the dream. And we'd better make sure, for the good of the country, that the dream is vibrant and alive.

It starts with having great education systems for every single child. (Applause.) It means that we unleash the faith-based programs to help change people’s hearts, which will help change their lives. (Applause.) It means we use the mighty muscle of the federal government in combination with state and local governments to encourage owning your own home. That’s what that means.

This is a content archive of VDARE.com, which Letitia James forced off of the Internet using lawfare.