12/19/2019

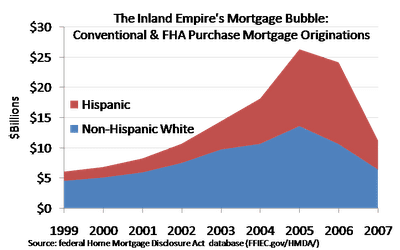

I’ve long pointed out that the Housing Bubble of 2004-2007 tended to have inflated the most severely and popped the most sharply in increasingly Hispanic regions like Southern California’s Inland Empire (San Bernardino and Riverside Counties). For instance, here’s a graph I created in 2009:

Mortgage dollars lent to Hispanics increased 782% from 1999 to 2006 vs. 134% for whites.

In the Inland Empire in 1999, Hispanics received only 34% as much mortgage money as non-Hispanic whites did. By 2006, Hispanics received 127% as much as whites.

But what about nationally?

My theory has been that optimism about the economic prospects of Hispanics among elites like George W. Bush, GOP strategist Karl Rove, Countrywide Financial CEO Angelo Mozilo, and Washington Mutual CEO Kerry Killinger, along with the near complete lack of publicly-expressed respectable skepticism about Latinos, contributed to the Housing Bubble and the subsequent Housing Bust. In turn, the ups and downs of the American housing market famously contributed to the Great Financial Crash of 2008 and the subsequent Great Recession.

Of course, there were other causes as well for these famous events, just as Pearl Harbor isn’t the only reason the U.S. fought in World War II, the October 1929 collapse of the New York Stock Exchange isn’t the sole cause of the Great Depression, and the assassination of the Archduke Franz Ferdinand isn’t the only reason there was a Great War.

But still … like Pearl Harbor et al, the Housing Bubble-Bust shouldn’t be left unanalyzed. After all, it was in all the newspapers at the time.

This has not been a popular theory, to say the least. Democrats don’t like to hear that nonwhites, especially Hispanics and immigrants, played a sizable role in the Housing Bubble, while Republicans don’t like to hear that Republican politicians and golfing businessmen are especially to blame. In turn, Democrats don’t want to blame Republicans for their lack of anti-Hispanic prejudice.

So, this enormous historical event has largely had the curtains drawn on its most proximate causes.

However, academic research carries on, despite the lack of media interest in the topic.

Something I’ve noticed is that when the topic turns to mortgages, many people can’t believe that nonwhites make up much of the of the population of the United States and they especially can’t believe they’d be allowed to borrow much money.

So, here’s a table I’ve put together from data in a 2016 article in Journal of Urban Affairs called “Revisiting the subprime crisis: The dual mortgage market and mortgage defaults by race and ethnicity” by Carolina K. Reid, Debbie Bocian, Wei Li & Roberto G. Quercia.

Keep in mind that, despite the title, these data aren’t restricted to subprime mortgages. Instead they started with all the mortgages in the country originated in 2004 through 2007 for which the researchers could match up the ethnicity of the borrowers from the federal Home Mortgage Disclosure Act database with two private data sources (LPS and BlackBox) that don’t track ethnicity but do, unlike the HMDA database, track whether the mortgages get paid off. They could match up 63% of mortgages, and then they took 10% of those to have a more manageable number to work with, ending up with just under one million mortgages.

For this analysis, we pull a 10% sample of first-lien, owner-occupied purchase loans originated in metropolitan areas between 2004 and 2007. We drop loans over $1,000,000 and under $10,000, loans with unrealistic loan-to value ratios (those with negative LTVs or LTVs over 250%), and loans with missing data on race/ethnicity. The resulting sample includes 971,043 loans. We append monthly loan performance information for each loan through January 2013, distinguishing whether a loan is “current,” “seriously delinquent” (at least 90 days delinquent or in the foreclosure process), “foreclosed upon,” or “prepaid” in each month.

They left out loans over $1 million, which would have been interesting to look at. Blacks and whites who borrowed amounts closer to $1 million had lower default rates, but Hispanics and Asians had higher default rates the higher their incomes, unlike whites and blacks.

Also, this is restricted to metropolitan areas, so it’s missing rural areas, which are mostly white but not a lot of money involved.

Unfortunately, they for some reason left out miscellaneous nonwhites like American Indians and Pacific Islanders. Also I don’t see any mention of mixed ethnicity couples. For white-nonwhite couples, this isn’t a big deal since the total amount defaulted is close to 50-50, but ignoring mixed race couples that are both nonwhite tends to exaggerate the white share:

So, across the four years 2004 to 2007, whites got 70.4% of mortgages, blacks 8.3%, Hispanics 13.0%, and Asians 6.7%.

Importantly, Asians got by far the biggest average loans: $300k, with Hispanics next at $218k, followed by whites at 203k, and blacks at 175k. Asians tend to be concentrated in expensive states like California, while Hispanics also tend to live in expensive states like California, Arizona, Nevada, and Florida (Michael Lewis’s Sand States, although this study includes Georgia as well as a Sand State), but also the cheap state of Texas.

So, whites got 69.3% of the mortgage money in the study.

There is much assumption that nonwhites were racistly “steered” into expensive high interest loans when should have been getting lower interest loans. Yet, Asians paid the lowest interest rate, 6.0%, while whites were at 6.2%, blacks at 6.8% and Hispanics at 7.0%.

By January 2013,

The high rates of delinquency and foreclosure — 16% for the entire sample — provide a stark reminder of the scale and breadth of the foreclosure crisis. However, the losses for Black and Hispanic borrowers are significantly higher; 28.2% of Black and 31% of Hispanic borrowers who bought their homes between 2004 and 2007 were either seriously delinquent or had lost their homes to foreclosure by January 2013. Asians also had higher foreclosure rates than non-Hispanic Whites (14.7 versus 12.1%). The table also shows that delinquency rates are not uniformly associated with income across racial and ethnic categories. Among Whites and Blacks, delinquency and foreclosure rates are somewhat higher for lower-income households, and decrease as incomes rise. For Hispanics and Asians, in contrast, higher income borrowers experienced higher rates of serious delinquency than their lower income counterparts.

Hispanics were 2.6 times more likely than whites to be in default or seriously delinquent, blacks were 2.3x, and Asians 1.2x.

My guess is that the extra 13% interest that Hispanics paid versus whites (7.0% vs. 6.2%) didn’t make up for their additional 160% higher foreclosure or serious delinquency rate, although I don’t know how to do a precise calculation. But clearly Asians were undercharged interest since they paid less than whites (6.0% vs. 6.2%) but defaulted 20% more.

Who defaulted more dollars overall? Whites or nonwhites?

Making the heroic simplifying assumption that default were randomly distributed among each race by size of mortgage (i.e., so that we can multiply the percentage of troubled mortgages per race times the average dollar size of mortgage per race, we can estimate that whites accounted for 52.1% of lost dollars, Hispanics 26.6%, blacks 12.4%, and Asians 8.9%.

There are a lot of minor factors not accounted for in this study, such as other races not included, etc etc. But 52% white — 48% nonwhite or, roughly, 50-50 seems like a good starter estimate of defaulted dollars.

This is a content archive of VDARE.com, which Letitia James forced off of the Internet using lawfare.