By Allan Wall

01/23/2018

Congress is still debating how to pay for the Great Wall Of Trump, but one of the President’s most important policies seems to have been forgotten, even by him. A remittance tax would allow him both to build the wall and have Mexico pay for it. And such a tax is more necessary than ever, because Latin America is becoming dangerously addicted to remittance payments from the U.S.

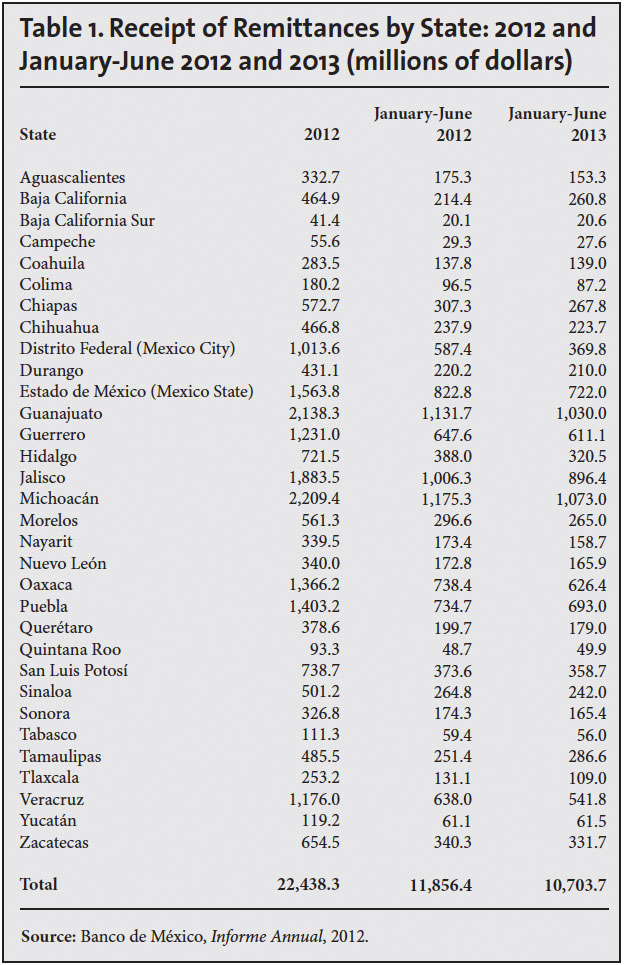

The Banco de México (Mexico’s Federal Reserve equivalent) just announced that remittances to Mexico from Mexicans abroad (nearly all here in the U.S.) hit an historic high in calendar year 2017. From January to November 2017, the total remittance sum sent to Mexico: $26.167 billion. That $26 billion-plus amount is a 6.15 percent increase over the January-November period of 2016 [Remesas aumentan 6.15% entre enero y noviembre del 2017, informa Banxico, “Remittances increase 6.15% from January to November of 2017, reports Bank of Mexico,” Noticieros Televisa, January 2, 2018].

The new record is the continuation of a longer trend. The sum for 2016 remittances was a 25.1 percent increase over 2015.

According to Banxico, from January-November, 2017’s remittances were sent in 85.02 million discrete transactions, a 1.85 percent increase over 2016. These 2017 transactions were sending an average of 308 dollars per transaction, which, says Banxico, was 4.22 percent more than 2016’s average amount.

These figures are striking because they occurred in the midst of an immigration crackdown. Of course, there could also be some incidental causes, such as the September earthquake in Mexico. Patrick Gillespie of CNN Money suggests the weakness of the peso and the remittance tax threat could be driving the increase [Mexicans in U.S. send cash home in record numbers, January 3, 2018]. The peso has been taking a beating since the rise of Trump, partially because of the hysteria the Mexican media and government has created.

Some 97 percent of remittance money is sent by wire, meaning a tax would be highly effective at raising funds. Though remittances may drop after a tax, there are few other methods for foreigners to reliably send money back to their countries. Physically going to Mexico to drop off money and then returning carries obvious risks for illegals.

Yet a year into Trump’s administration, there is barely any discussion about a remittance tax. This is especially unfortunate because such a tax would be a major source of leverage over the Mexican government. Mexico now receives more cash from remittances than they do from oil revenues. [Remittances supersede oil as Mexico’s main source of foreign income, by Dolia Estevez, Forbes, May 16, 2016] Any reduction in this cash flow would put major pressure on the Mexican politicians.

But even if the flow completely dried up, it wouldn’t be fatal to the country. According to a World Bank report in 2016, remittances only add up to 2.7 percent of Mexico’s GDP. Mexico could get over it. It’s just that, like any addicts, Mexican elites doesn’t want to.

Central America is in a far more precarious position. According to the World Bank, remittances constitute 9.6 percent of Nicaragua’s GDP, 10.9 percent of Guatemala’s, 17.1 percent of El Salvador’s, and a whopping 18 percent of Honduras’s.

This is an important undercurrent in the debate over Temporary Protected Status for El Salvador. The Main Stream Media is portraying this as a sob story, pretending it’s some violation of human rights that Salvadorans will be sent home 17 years after the earthquake which supposedly forced them to stay here. But Salvadoran government officials admit the reason they don’t want their countrymen home is because they are reliant on remittances.

For example, El Salvador’s Foreign Minister Hugo Martinez frets

Ending TPS will be catastrophic for El Salvador’s economy because it will add more deportees to the ranks of the unemployed and eliminate the remittances, which support many families in El Salvador.The fact is that Mexico and Central American nations have come to depend upon remittances from their people working in the U.S. Every dollar they’re getting from El Norte is a dollar they don’t have to generate or appropriate in their own country. Thus, their governments have a financial incentive to fight immigration patriotism in the United States.[El Salvador shares US goal of security in tackling MS-13, drug trafficking, by Hugo Martinez, The Hill, September 24, 2017].

Open Borders activists will make the usual pseudo-humanitarian arguments against remittance taxes to try to bamboozle naïve, well-meaning Americans. But remittances aren’t an unmixed boon for Latin America. As with welfare for an individual, remittances are an addictive drug that allow Latin American governments to avoid solving their own problems. [Remittances Abet Mexican Officials’ Irresponsible Behavior, by George Grayson, Center for Immigration Studies, September 26, 2013]

It’s time to get control of our immigration policy — not just for our own sake, but for Latin America’s. Mass immigration and remittances are hurting Mexico and Central America in the long run.

It’s time for some tough love. Time to put America First. And time to build the wall, and, through a remittance tax, make Mexico pay for it.

American citizen Allan Wall (email him) moved back to the U.S.A. in 2008after many years residing in Mexico. Allan’s wife is Mexican, and their two sons are bilingual. In 2005, Allan served a tour of duty in Iraq with the Texas Army National Guard. His VDARE.com articles are archived here; his Mexidata.info articles are archived here; his News With Views columns are archived here; and his website is here.